This results in increased business consumption because factories must buy raw materials to produce these goods. This increased consumption creates a virtuous circle that generates more investment, consumption and employment in the economy. Since authorities spending is one of the parts of combination demand, a rise in authorities spending will shift the demand curve to the proper. A reduction in taxes will go away more disposable revenue and trigger consumption and savings to increase, also shifting the mixture demand curve to the best. This has the potential to slow economic progress if inflation, which was brought on by a significant increase in aggregate demand and the availability of cash, is excessive. By reducing the economy’s amount of mixture income, the obtainable amount for customers to spend can be reduced.

The crowding-out effect is shown in the model above, where a government budget deficit increases demand for borrowing in the market for loanable funds. As a result demand for loanable funds increases from D1 to D2, increasing the number of funds loaned from Q1 to Q2 and increasing the market interest rate from I1 to I2. The increase in market interest rates will discourage private spending, hence creating a ‘crowding-out effect. If the government ran a surplus budget, then it would increase the supply of loanable funds, lowering the interest rate and encouraging private spending, hence creating a ‘crowding in’ effect.

Saving on a Valuable Education (SAVE) Plan: What to Know – Investopedia

Saving on a Valuable Education (SAVE) Plan: What to Know.

Posted: Tue, 18 Jul 2023 07:00:00 GMT [source]

A large criticism of government expenditure has been the National Broadband Network (NBN), which argues private sector could have implemented the program more efficiently and cheaply. In the long term, fiscal spending could displace private spending. Fiscal policy is predicated on the theories of British economist John Maynard Keynes. Also often known as Keynesian economics, this theory principally states that governments can influence macroeconomic productiveness levels by increasing or reducing tax ranges and public spending.

Fiscal Policy vs. Monetary Policy

Automatic stabilizers are fiscal mechanisms built into government budgets, such as taxes, unemployment insurance, and welfare programs. Following the war, large-scale unemployment was no longer a problem. What was proving to be significantly troubling, however, was the surge in inflation. Economic growth, which advanced at a rapid rate, began experiencing short periods of shallow recession. Businesses and investors identify an opportunity when there is an expansionary policy since the government allows more money to flow into the economy.

- Lower taxes mean more disposable income, which leads to additional spending and economic growth.

- During a recession, the government might employ expansionary fiscal coverage by reducing tax rates to extend mixture demand and gas financial development.

- This is done to increase the money supply in a nation, where all these will boost the economy and increase economic activities in a nation.

This means that to help stabilize the economy, the government should run large budget deficits during economic downturns and run budget surpluses when the economy is growing. These are known as expansionary or contractionary fiscal policies, respectively. When private sector spending decreases, the government can spend more and/or tax less in order to directly increase aggregate demand. When the private sector is overly optimistic and spends too much, too fast on consumption and new investment projects, the government can spend less and/or tax more in order to decrease aggregate demand. In Keynesian economics, aggregate demand or spending is what drives the performance and growth of the economy. Aggregate demand is made up of consumer spending, business investment spending, net government spending, and net exports.

Central government borrowing

However, if the tax cuts are directed at the poorest of society, those who spend all their income, they are far more effective. When the contractionary policy is implemented, it slows down inflation, taxes are raised, and the growth of businesses is slowed down. Contractionary fiscal policy may also lead to the total death of new businesses which cannot keep up with the current economic events.

To combat inflation, the federal government may use contractionary fiscal policy. Central banks use expansionary financial policy to lower unemployment and keep away from recession. Businesses borrow extra to purchase tools, rent employees, and increase their operations. Individuals borrow more to purchase more homes, cars, and home equipment. On the other hand, contractionary fiscal coverage entails growing tax rates and decreasing government spending in hopes of slowing financial progress for varied reasons.

Multiplier, Accelerator and Keynesian Economics (Revision Presentation)

For this reason, expansionary is sometimes detrimental to the economy. The two major fiscal policy tools that the U.S. government uses to influence the nation’s economic activity are tax rates and government spending. It typically works on a national level, but not at a global level.

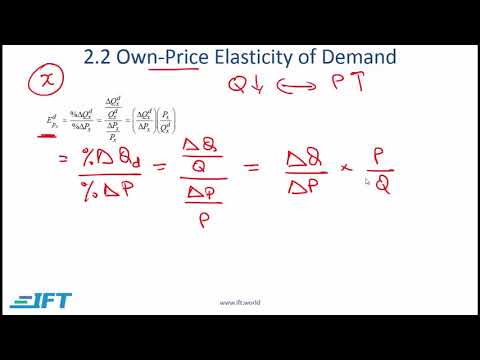

When government spending changes by $1, consumers consume an amount c, called the marginal propensity to consume, and saving an amount equal to 1 – c, which is called marginal propensity to consume. The amount c spent advantages and disadvantages of fiscal policy by consumers become incomes of some other agents who consume (1 – c)c and save the rest. This way, just like the process of money creation, the initial stimulus of $1 increases total income/output by 1/(1 – c).

What are the 3 tools of fiscal policy?

The Congressional Research Service says that in a recession, for example, demand drops, wages drop, employment shrinks and businesses make less money. Effective government spending can keep the economy from shrinking too much, which keeps people employed and businesses open. Governments likewise use fiscal policy to respond to natural disasters, spikes in food or fuel prices or to help citizens deal with problems such as expensive health care. Adjusting interest rates can determine whether getting credit is easy or expensive.

That’s why specific groups of people are generally targeted for more money when fiscal policies need it. Federal Reserve Board and refers to actions taken to increase or decrease liquidity through the nation’s money supply. According to Keynesian economists, the private sector components of aggregate demand are too variable and too dependent on psychological and emotional factors to maintain sustained growth in the economy. The central banks can decide to use all of these tools simultaneously, individually, or in whatever combination they think is appropriate to help the economy. Although there is a minimal risk of non-compliance, financial institutions typically work with one another to provide the foundational support of the economy. They are ready to implement the ideas of the central banks immediately, especially if there are incentives in place to do so.

Pros and Cons of Contractionary Monetary Policy

In 2015, UK government borrowing totalled £75.3bn, which was approximately 5% of GDP, with accumulated debt standing at 83.3% of GDP. The central financial institution of a country primarily administers financial coverage. In India, the Monetary Policy is beneath the Reserve Bank of India or RBI. Fiscal policy rests on a government’s decision to spend more or less than it receives in revenue.

Fiscal policies are implemented at the macro level of the economy. Failure to feel the effect does not imply fiscal policies are not effective. However, you are likely to feel the effect at the business level and more dominantly in the sector where you are economically active. – For example, if the government increase spending it will have to increase taxes or sell bonds and borrow money, both methods reduce private consumption and investment. If this occurs, AD will not increase or increase only very slowly. Groceries and basic household items come first, followed by discretionary items, such as new clothes and furniture.

List of the Cons of Monetary Policy

What’s more, excessive public sector exuberance during good times can lead to an overheated economy and inflation. When interest rates are set too low in an economy, then it is not unusual for an excessive amount of borrowing to occur because the interest rates are artificially cheap. This process creates what is called a “speculative bubble.” It causes prices to increase too quickly, and often to levels that are ridiculously high.

In economics and political science, fiscal coverage is the usage of government revenue assortment (taxes or tax cuts) and expenditure (spending) to influence a rustic’s economy. Fiscal and monetary coverage are the important thing methods utilized by a country’s government and central financial institution to advance its financial goals. The mixture of these policies permits these authorities to focus on the inflation (which is considered “wholesome” on the level in the range 2%–three%) and to extend employment. Fiscal policy means the use of budgets and related legislative measures to try to influence the direction of the economy. Expansionary fiscal policy refers to reducing taxes and increasing government spending to stimulate the economy. The multiplier effect of expansionary policy spurs economic growth, which leads to increased investment, consumption and employment.

Leave A Comment