Compensation for Part IX is reported based on the accounting method and tax year used by the organization, rather than the definitions and calendar year used to complete Part VII or Schedule J (Form 990) regarding compensation of certain officers, directors, trustees, and other employees. Fundraising expenses are the expenses incurred in soliciting what does 990 mean cash and noncash contributions, gifts, and grants. Report as fundraising expenses all expenses, including allocable overhead costs, incurred in (a) publicizing and conducting fundraising campaigns; and (b) soliciting bequests and grants from individuals, foundations, other organizations, or governmental units that are reported on Part VIII, line 1.

About Form 990, Return of Organization Exempt from Income Tax

In this case, the procedures applicable to requests for accounting method changes (for example, the requirement to file a Form 3115) are not applicable. A tax-exempt political organization must file Form 990 or 990-EZ if it had $25,000 or more in gross receipts during its tax year, even if its gross receipts are normally $50,000 or less, unless it meets one of the exceptions for certain political organizations under Section B, later. A qualified state or local political organization must file Form 990 or 990-EZ only if it has gross receipts of $100,000 or more. Section 501(c)(7) and 501(c)(15) organizations apply the same gross receipts test as other organizations to determine whether they must file Form 990, but use a different definition of gross receipts to determine whether they qualify as tax exempt for the tax year. See Appendix C. Special Gross Receipts Tests for Determining Exempt Status of Section 501(c)(7) and 501(c)(15) Organizations for more information. Organizations that have $1,000 or more for the tax year of total gross income from all unrelated trades or businesses must file Form 990-T to report and pay tax on the resulting unrelated business taxable income (UBTI), in addition to any required Form 990, 990-EZ, or 990-N.

- Unfortunately, that won’t spare you from a yearly filing with the Internal Revenue Service (IRS).

- Most tax-exempt nonprofits must file a 990 form with the Internal Revenue Service every year, typically in mid-May.

- Organizations that file Form 990 use this schedule to report the types of noncash contributions they received during the year and certain information regarding such contributions.

- An organization manager isn’t considered to have participated in an excess benefit transaction where the manager has opposed the transaction in a manner consistent with the fulfillment of the manager’s responsibilities to the organization.

- Include lobbying expenses in this column if the lobbying is directly related to the organization’s exempt purposes.

Form 990-PF

Management duties also don’t include investment management unless the filing organization conducts investment management services for others. An excess benefit transaction can also occur when a disqualified person embezzles from the exempt organization. Enter the net amount of all notes receivable and loans receivable not listed on lines 5 and 6, including receivables from unrelated third parties. The term “unrelated third parties” includes independent contractors providing goods or services and employees who aren’t current or former officers, directors, trustees, key employees, highest compensated employees, or disqualified persons. Enter the organization’s total accounts receivable (reduced by any allowance for doubtful accounts) from the sale of goods and the performance of services. Report claims against vendors or refundable deposits with suppliers or others here, if not significant in amount.

Independent Voting Members of the Board

For Form 990, see Part V, line 3, and its instructions; for Form 990-EZ, see Part V, line 35, and its instructions. Treatment as a new contract can cause the contract to fall outside the initial contract exception, and it would thus be tested under the FMV standards of section 4958. Reasonable compensation is the valuation standard that is used to determine if there is an excess benefit in the exchange of a disqualified person’s services for compensation.

- Any contribution of a qualified real property interest to a qualified organization exclusively for conservation purposes.

- An organization isn’t treated as a section 501(c)(3), 501(c)(4), or 501(c)(29) organization for any period covered by a final determination that the organization wasn’t tax exempt under section 501(a), so long as the determination wasn’t based on private inurement or one or more excess benefit transactions.

- See the Glossary and instructions for the pertinent schedules for definitions of terms and explanations that are relevant to questions in this part.

- If the request is made in writing, the notice must be provided within 7 days of receiving the request.

- However, certain returns and return information of tax-exempt organizations and trusts are subject to public disclosure and inspection, as provided by section 6104.

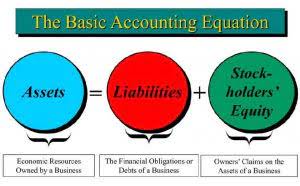

See the special rules below regarding section 501(c)(21) black lung trusts, controlling organizations under section 512(b)(13), and sponsoring organizations of donor advised funds. The Statement of Financial Position includes assets, liabilities, and net assets. There is no requirement for nonprofits to show current assets or current liabilities so typically those are not identified.

A credit counseling organization collects amounts from debtors to remit to creditors and reports the amounts temporarily in its possession as cash on line 1 of the balance sheet. It must then report the corresponding liability (the amounts to be paid to the creditors on the debtors’ behalf) on line 21. The amount reported must equal the total of Schedule D (Form 990), Part VI, column (d). Use Schedule O (Form 990) to report the FMV of the trust’s assets at the beginning of the mine operator’s tax year within which the trust’s tax year begins.

Forms & Instructions

Report on this line predetermined quota support and dues (excluding membership dues of the type described below) by local agencies to their state or national organizations for unspecified purposes, that is, general use of funds for the national organization’s own program and support services. Enter contributions by the filing organization, common paymasters, and payroll/reporting agents to the filing organization’s employee benefit programs (such as insurance, health, and welfare programs that aren’t an incidental part of a pension plan included on line 8), and the cost of other employee benefits. For an employee who works on fundraising 40% of the time and program management 60% of the time, an organization must allocate that employee’s salary 40% to fundraising and 60% to program service expenses.

Transactions to be reported in Schedule L include excess benefit transactions, loans to/from interested parties, grants or assistance benefiting interested parties, and business transactions involving interested parties. Form 990 T is an important tax document that select nonprofits have to file if they need to report unrelated business income. When https://www.bookstime.com/ considering how best to report your information either in your financial statements or in your Form 990, first consider who will be reading the information as they may have different nonfinancial objectives that can be displayed via these reports. Donors and grantors want to ensure that the mission is in alignment with their own values and goals.

Leave A Comment