He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

Manufacturing Overhead Budget

- Operating profit was $535,000 for the period, calculated by taking the gross profit of $700,000 minus operating expenses and depreciation and amortization of $15,000 (labeled as total expenses).

- You estimate net sales by multiplying the expected number of units sold by price per unit.

- It is calculated by taking a company’s revenue and subtracting the cost of goods sold (COGS) and operating expenses.

This encourages customers to buy more items from the company, which will increase revenue and operating profit. A company can increase its operating profit by reducing the cost of goods and services it sells. From the example above, gross profit was $700,000 for the period, achieved by subtracting $150,000 in COGS from the revenue of $850,000.

What is your current financial priority?

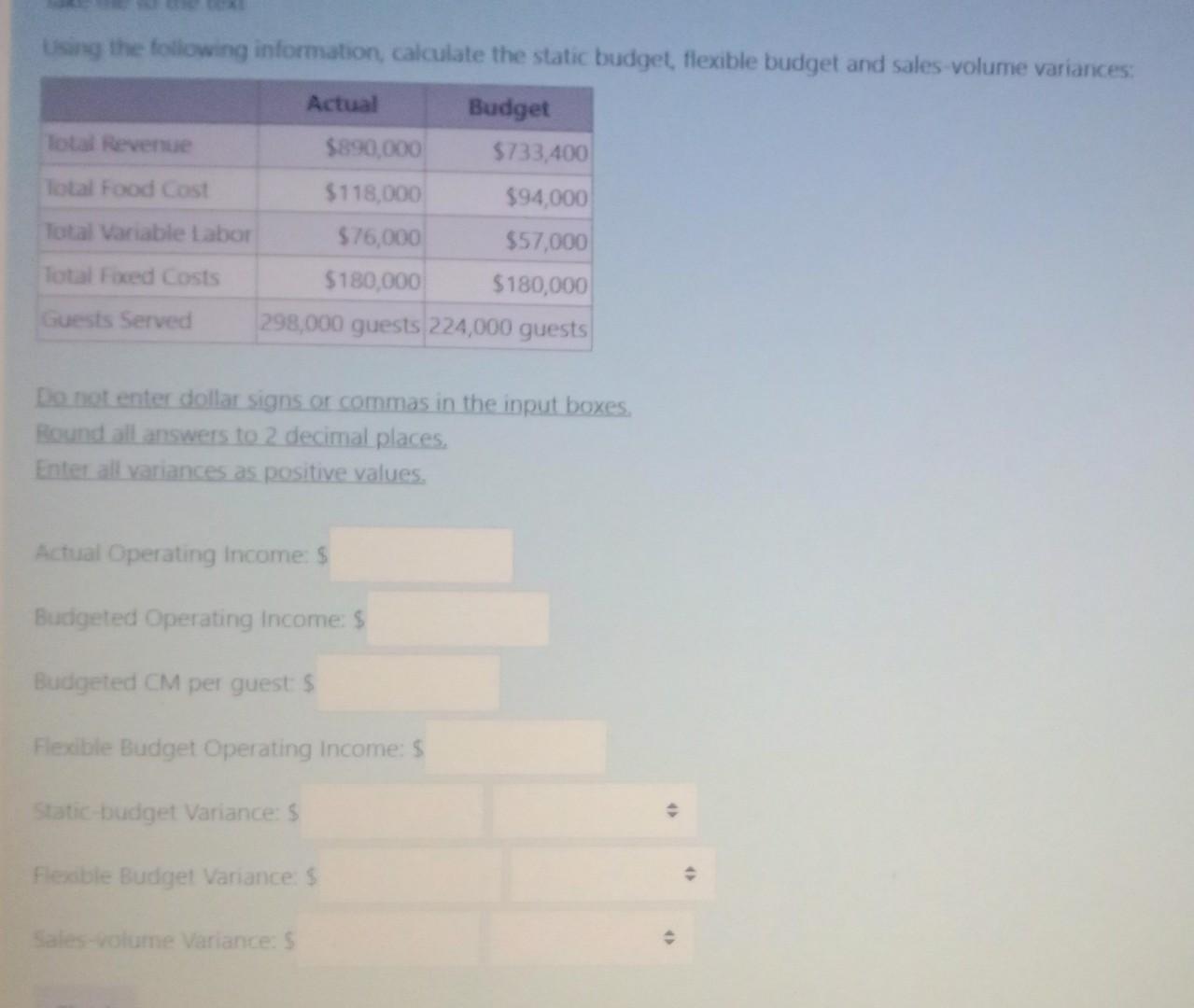

Management uses the same information in the production budget to develop the direct labor budget. After management has estimated how many units will sell and how many units need to be in ending inventory, it develops the production budget to compute the number of units that need to be produced during each quarter. Companies must factor in a number of expenses to run a business, and sometimes these costs exceed revenues, resulting in lower operating income and profit. When a company has healthy revenues and operating income, this results in stronger operating margins. However, what is considered a strong operating margin often varies across different industries.

Ask Any Financial Question

However, it is advisable to prepare the current year’s financial projections at quarterly intervals to monitor the actual performance compared to budgeted numbers at the end of every quarter. It is merely the combination of the Sales/Revenue Budget, budgeted operating income Cost of Goods Sold Budget, Operating expense budget, and cash budget. Nonoperating revenue is the money that a business earns from side activities unrelated to its daily activities, such as profits from investments or dividend income.

2: Prepare Operating Budgets

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

Direct Labor Budget

The ending inventory from one quarter is the beginning inventory for the next quarter and the calculations are all the same. In order to determine the ending inventory in quarter 4, Big Bad Bikes must estimate the sales for the first quarter of the next year. Thirty percent of 3,500 is 1,050, so the number of units required in the ending inventory for quarter 4 is 1,050.

Operating income, often referred to as EBIT or earnings before interest and taxes, is a profitability formula that calculates a company’s profits derived from operations. In other words, it measures the amount of money a company makes from its core business activities not including other income expenses not directly related to the core activities of the business. The sales, cost of goods sold, and selling and administrative cost budgets are supporting budgets that are combined to produce a budgeted income statement for the year. Operating income is the amount of profit left after considering all operating expenses and subtracting those expenses from the company’s revenue. This type of income is listed on the income statement, which includes a summary of a business’s revenue and expenses for a specified period.

This could be due to a one-time charge, poor financial decisions made by the company, or an increasing interest rate environment that impacts outstanding debts. Alternatively, a company may earn a great deal of interest income, which would not show up as operating income. The selling and administrative expenses come off the budget of the same name. We subtract those from our gross margin to come to a net operating income. For financed properties, NOI is also used in the debt coverage ratio (DCR), which tells lenders and investors whether a property’s income covers its operating expenses and debt payments. NOI is also used to calculate the net income multiplier, cash return on investment, and total return on investment.

Therefore, the determination of each quarter’s material needs is partially dependent on the following quarter’s production requirements. The desired ending inventory of material is readily determined for quarters 1 through 3 as those needs are based on the production requirements for quarters 2 through 4. To compute the desired ending materials inventory for quarter 4, we need the production requirements for quarter 1 of year 2. Recall that the number of units to be produced during the first quarter of year 2 is 3,800. That information is used to compute the direct materials budget shown in Figure 10.9.

Operating income includes expenses such as costs of goods sold and operating expenses. However, operating income does not include items such as other income, non-operating income, and non-operating expenses. Management uses the same information in the production budget to develop the direct labor budget.

Leave A Comment